Past Webinars

Julia Holian is a seasoned Career Strategist dedicated to helping individuals make pivotal career moves that align with their skills, interests, and values. With her expertise as a Gallup-Certified Strengths Coach and Certified Professional Coach, Julia empowers professionals from various sectors to assess their current situation and plan for a fulfilling career future.

In this session, we explore crucial topics such as:

- Why women don’t contemplate a job change when it’s time

- How to evaluate whether to stay at your job or find a new one

- If you stay: How to language crafting your ideal job or asking for more money

- If you go: Strategies to use to find that job and help you get it

Don’t miss this opportunity to gain valuable insights and practical advice to empower your financial future and take charge of your late-career journey. Watch an inspiring and informative discussion with Julia Holian on how to create a career that’s not just successful but also personally fulfilling.

Are you facing the impending challenge of sending a child off to college and realizing that you may not

qualify for need-based aid? Do financial concerns about covering the cost of higher education weight

heavily on your mind, wondering how you will manage retirement funding, your other kids’ K-12 private

school tuitions, caring for aging parents, or other financial obligation?

You may have options. If you feel you’re resigned to depleting a 529 plan or taking on student loans,

this is your opportunity to explore less-obvious alternative options.

Jessica and Jack dive into:

- Strategies for optimizing your college savings and minimizing student loan debt

- Creative approaches to college funding for high-income earners

- Tax-efficient financial planning techniques tailored to college expenses

- Alternative financial resources and options beyond traditional savings plans

Gain fresh insights and practical guidance for navigating the complex world of college funding. Watch the recording to unlock a brighter financial future for both you and your child!

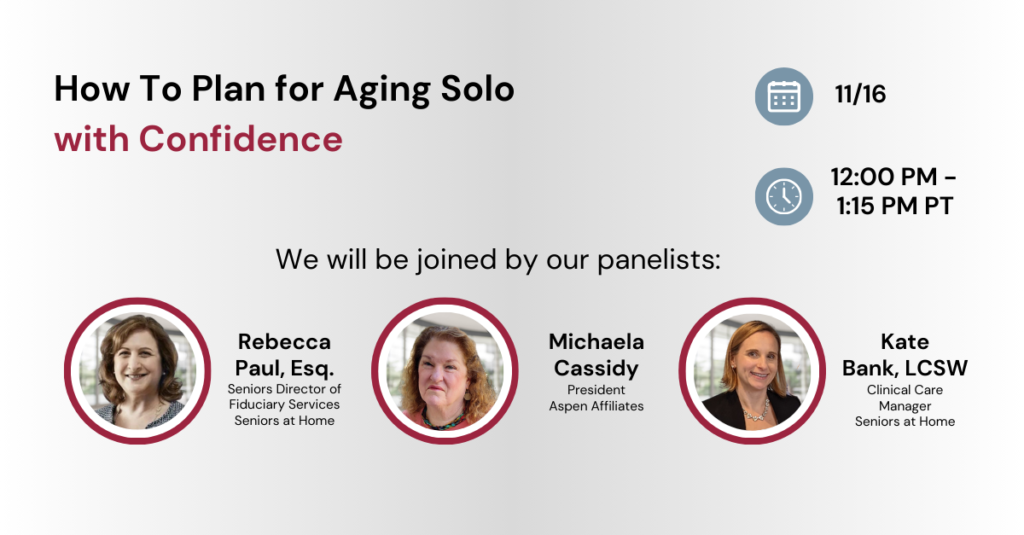

Are you planning to live independently as you age? Are you concerned that if a partner passes prematurely you might end up on your own? Aging solo is about choosing to live on one’s own despite not having family, children, or young friends close by to support you in your care.

With families spread out in the country and across the globe, more adults are preparing to age in place without the support of nearby family members, children, or younger friends. While this may be empowering, it can also be scary. Join Jessica and her panel of experts to learn about aging solo and how to prepare.

Together, they discuss:

How to adopt a positive and empowered mindset about living independently in your later years.

The essential steps to take now to enhance your chances of a successful aging experience.

Why comprehensive planning matters, including estate planning, medical planning, and housing arrangements.

Discovering options for receiving care and support even when family is geographically distant.

What actionable steps you can take today and what to keep in mind for the future to ensure your well-being and security.

.

Spots are filling up fast!

Secure your spot today and embark on a journey to empower your financial future and navigate late-career transitions with confidence. We look forward to seeing you there!