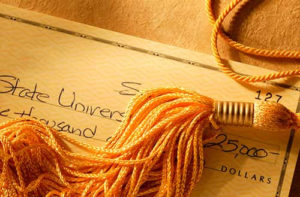

How Much Will College Really Cost?

The average cost of a public four-year  in-state college education, including room, board, and fees, can add up to approximately $21,000 per year — and that’s just in today’s dollars (Source: Trends in College Pricing 2018). While your first thought may be to protect your child from a lifetime of student loan payments, it’s equally important to consider how covering all or a portion of these costs could affect your own future. Unlike your children, you no longer have 40-plus years ahead of you to plan.

in-state college education, including room, board, and fees, can add up to approximately $21,000 per year — and that’s just in today’s dollars (Source: Trends in College Pricing 2018). While your first thought may be to protect your child from a lifetime of student loan payments, it’s equally important to consider how covering all or a portion of these costs could affect your own future. Unlike your children, you no longer have 40-plus years ahead of you to plan.

Let’s assume you’re 50 when your child begins attending college and you pay approximately 60% of the cost, for a total of $12,500 per year for four years. That’s $50,000 not going toward your IRA, 401(k), or other investment options. Assuming you retire at age 65 and earn a 4% annual average return between now and your planned retirement time, you just forfeited more than $85,000 in potential retirement funds — enough to provide you an extra $300 each month in interest alone, assuming a continued 4% annual return during your retired years.

You might also be contemplating taking out a loan to cover college costs. Once those loans are due, you’re opting to juggle both retirement investing and debt at a time when you should be saving more toward retirement than ever. Keep in mind, there are far fewer options for parents when it comes to loan repayment and/or forgiveness than there are for students. And even if you’re willing to sacrifice an extra few years of retirement to finance your children’s college education, you may feel differently as you grow older — especially if factors such as unforeseen health issues or fluctuations in the economy impact your plans to work longer.

On the other hand, your child has his/her entire life to pay off student loan debt, even if it means putting in extra hours or sacrificing discretionary spending for a while. Unlike you, he/she has decades of working years ahead to manage college debt.

The good news is you can still help your college-bound children in ways that significantly reduce their burden without impacting your retirement plans:

Provide Food and Shelter

The average cost of room and board ranged from approximately $11,000 to $12,700 annually for the 2018-2019 school year, accounting for as much as half of the annual costs of college (Source: Trends in College Pricing 2018). When you consider that the expense of a dorm room and food can essentially double the costs of college, the simple act of continuing to house and pay for your children’s necessities during their college years can save them from accumulating tens of thousands of dollars in debt. While staying home may not exactly hold the same thrills as the traditional college experience, there are numerous benefits that offset forgoing that experience.

Additionally, because your child is taking advantage of your free room and board by attending a local college, you’ll also inadvertently help them dodge the costs of pricier out-of-state or private colleges that can double the cost of tuition (and accumulated debt).

Cut Back on Unnecessary Spending

Vacations, new car payments, and even the daily latte you enjoy add up quickly. You may be surprised at how much you can contribute by skimping on spending for a few years until your child graduates. To take advantage of extra savings, print out prior credit card and bank statements and scrutinize each expense line by line, asking yourself if it’s an essential or simply a want. Forgoing these costs can provide you with hundreds of extra dollars each month to help your son or daughter with tuition. Tip: Make sure everyone is making sacrifices, not just mom or dad. Call a family meeting and discuss the financial advantages of making sacrifices.

Plan Ahead

If your children are still young, investing in a 529 plan, Roth IRA, or alternative investment each month while continuing to maximize your retirement contributions can make a huge difference in college costs down the road. Even encouraging family members and loved ones to give college savings money as gifts can quickly add up.

Remember, with your help and encouragement, your children can combine income from savings, part-time jobs, grants, scholarships, and loans to finance their college education in a manageable way once loan payments become due. Furthermore, because they’re actively involved in the financial aspects of their educations, they’re much more likely to stay on track and value the many gifts college education affords. While they may begin their adult lives with some debt, they have the energy and time you don’t to pay it off. And because you were savvy when it came to your retirement, they won’t be faced with the obligation to financially help you in your old age.