September 2, 2022

Ask your average person on the street this question: If your investment loses 50% of its value, what rate of return does it need to get back to even?

A majority of people will knee-jerk the response of “50%” and not even realize how wrong they are.

This article will review that math and explain why it’s important to know and how to apply it to your own investing.

Why the 50% Response Is Wrong

When people answer the question above, they’re thrown off by working in percentages rather than dollar amounts, and most of our brains don’t operate well with percentages and get flustered. The easy, but wrong reaction, becomes 50%.

The trick is to work with the dollar figure and do the math. For you math-avoidant folks, let me do it for you.

If you have a stock that you bought for $30 and it loses 50%, it’s now worth $15 (half its value). Ignore the percentage for a minute and work with the $15 amount.

How much does $15 need to appreciate to get to $30? It needs to appreciate 100% — 100% of $15 is $15 and $15 plus $15 is $30.

This may be both eye-opening and humbling for many of you, if not terrifying. The 50% loss was bad enough. Needing a 100% return may land as impossible or as something that will take a very long time.

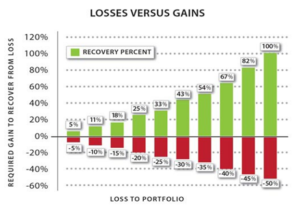

This chart shows you the returns necessary (green bar above the horizontal line) to overcome the losses experienced (red bar below).

Source: “The Value of Downside Protection.” WT Wealth Management. Web. April 2018.

Next Most Common Instance: Undervaluing ESPP

As a quick side note here, the second place I see this mistake happen most often is in Employee Stock Purchase Plans (ESPP). These plans allow employees to purchase stock at a discount.

For instance, let’s say ABC employee can buy ABC stock at a 15% discount every quarter. On July 1, let’s say the stock is worth $100. The employee gets to buy it for $85, probably thinking “What a deal! I’ll sell now at $100 and get an instant 15% return on my money!”

Well, no. It’s an 18% return on his money because if he held the stock at $85, he’d need an 18% return to get back to “even.” See the chart above. And, yes, it is most likely a good deal. That’s why they call them employee benefits.

What This Means for Your Portfolio

Let’s go back to the potentially eye-opening and humbling example of realizing that a 50% loss requires a 100% return to get back to even.

For those of you who were invested from 2000 to 2016, might perhaps recall the following experience.

The S&P500 (stock index) lost about 40% from 2000 to 2002. We commonly refer to this as the “tech correction” or the “tech crash.” The S&P got back to “even” about five years later, which was about 2007, just in time for the “housing crash” or “financial crisis” to start.

The S&P lost about 50% from 2007 to 2009 during the financial crisis. It recovered four years later in 2013 when it was “back to even” with 2000. You, of course, did not start opening your statements again until 2016, when it was safe again and you actually saw some gains.

From another perspective, the market made no money from 2000 to 2013. That’s thirteen years. That’s a long time not to make any money. With any luck, you were investing money in the downturns, even if just funding your retirement accounts. Indeed, the folks who have made the most money in the last two decades are those who invested at the bottom in 2009.

A 40% or 50% is a giant pothole in your investments. You’re going down the road of investing, hit this giant pothole and wonder why your back hurts and worry about what parts of your car were left behind. It’s going to take substantial returns and a chunk of time to get back to even. You’re starting to think about working longer.

How To Manage the Potholes

Imagine this instead: What if the pothole happens, but rather it being as deep at 40% or 50%, it is instead a 20% loss? Now you only need a 25% return to get back to even and then you’re quickly back on track to your financial destination.

Your back doesn’t hurt.

You’re not worried about whether your car is intact.

You love that you’re back on track and on your way.

How do you do this? The answer will be unique to everyone, but these basic principles apply.

Create ballast. Ballast is the concept of creating stability in a vessel by placing large, heavy material in its hull. You need the same in your portfolio.

The answer to this has traditionally been bonds but given that bonds have had some unfortunate and uncharacteristic timing in their losses (see the first half of 2022), it’s been a less reliable source of ballast.

We routinely expect bonds to hold steady or gain value when stocks lose value. Doesn’t always happen anymore. Consider shorter duration bonds in these moments or a laddered bond portfolio.

You may also consider that dreaded investment – the annuity. There are also strategies built on a life-insurance chassis and other cash alternatives worth reviewing.

Tactical asset management. This is a style or philosophy of investing. It is an active management strategy that shifts the percentage of assets held in various categories (including cash) to take advantage of market pricing anomalies or strong market sectors. It tends to look for trends and take advantage of them.

Unlike a buy-and-hold strategy (otherwise known as buy-and-hope), there tends to be a lot of trading that happens, hence the word “active.” And, yes, there can be tax sequences to active trading, and you need to mindful of your after-tax return.

This style of investing can provide the yang to the yin of your other investments and ultimately reduce your overall losses, especially if it has a focus on doing so. If you can keep your potholes more shallow when the storm is blowing, then you can catch more upside when the wind is at your back again.

If you would like to discuss how to keep your investing potholes to a minimum, please reach out.

Lanning Financial Inc. is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.